- [23/Mar/2017]

Iskandar Malaysia attracts RM32.15 billion in investments for 2016

.. more - [22/Mar/2017]

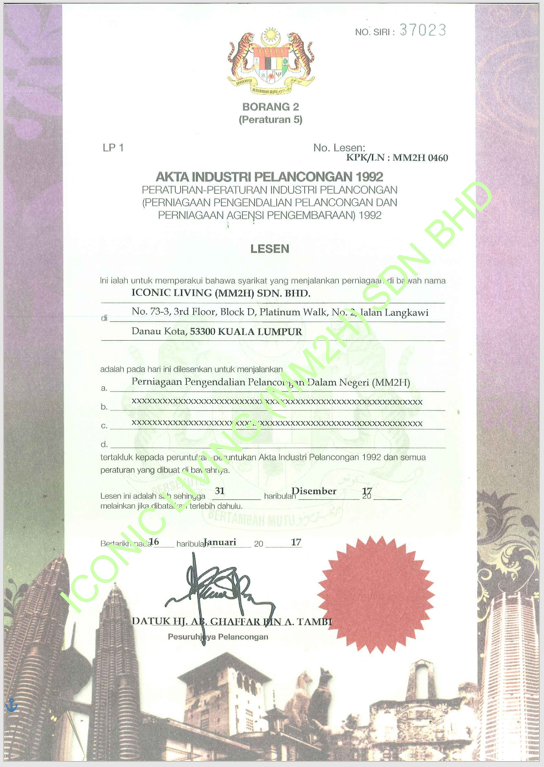

More than 30,000 applications from foreign nationals for MM2H approved - Nazri

.. more

Circular Pursuant to the Anti-Money Laundering and Anti-Terrorism Financing

Circular Pursuant to the Anti-Money Laundering and Anti-Terrorism Financing

10/Nov/2014

Circular Pursuant to the Anti-Money Laundering and Anti-Terrorism Financing (Security Council Resolution) (Al-Qaida and Taliban) (Amendment) Order 2014

Effective Date: 10 September 2014

Applicability

1. Authorised person, an operator of a designated payment system, a registered person, as the case may be, under the Financial Services Act 2013 (FSA) and Islamic Financial Services Act2013 (IFSA);

2. Prescribed institutions under the Development Financial Institutions Act 2002 DFIA);

3. Money services business licensed under the Money Services Business Act 2011 (MSBA); and/or

4. Reporting Institutions under the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 (AMLATFA)

Summary

The purpose of this circular is to inform institutions that the Minister of Home Affairs has issued the Anti-Money Laundering and Anti-Terrorism Financing (Security Council Resolution) (Al-Qaida and Taliban) (Amendment) Order 2014 (hereinafter referred to as the "Order"), which has been gazetted and enforced from 10 September 2014.

This amended Order is to give effect to the assets freeze measures imposed by Security Council of the United Nation, which is provided under Sections 66C and 66D of the AMLATFA by making direct reference to the Consolidated Lists available in the UN website for both Resolutions pertaining Al0Qaida and the Taliban.

For the implementation of this Order, all institutions are required to regularly check the list of specified individual and entities from United Nation's website as follows:

a. 1267 Committee List (Al-Qaida Sanction List): http://www.un.org/sc/

committees/1267/aq_sanctions_ list.shtml

Institutions are reminded that the following requirements under Anti-Money Laundering and Anti-Terrorism Financing (Security Council Resolution) (Al-Qaida and Taliban) Order 2011 [P.U.(A)402] are still applicable and institutions are require to:b. 1988 Committee List (Taliban Sanction List): http://www.un.org/sc/

committees/1988/list.shtml

In addition, with effect of the Order, all property owned, undertaking owned or controlled directly or indirectly by the specified entity can be released automatically once the specified entity is delisted from the Consolidated Lists in the United Nations' website.

a. freeze without delay all property owned, undertaking owned or controlled directly or indirectly by the specified entity;

b. reject or block any transaction by the specified entity and/or

c. report such determination that they are in possession or control of the property owned or controlled by or on behalf of the entity to the Financial Intelligence and Enforcement Department (FIED), Bank Negara Malaysia at every six months interval (January and July).